Government Bonds are debt instrument which comes with the highest safety in the market, here government borrows money from the public as per the spending requirements and in return provides a regular interest income to the lender. Generally, Government bonds are treated as a Risk Free Asset because the government of a country makes the commitment to repay the maturity and any interest amount of bonds at the end of the bond tenure or at the maturity date of bonds. Government Bonds have a Sovereign Rating which is the highest rating for any debt instrument within a country.

Generally, In India government bonds are issued by the Reserve Bank of India on behalf of the Central Government and State Government. Sometimes state government bonds are called as State Development Loans (SDLs).

Types of Government Bonds

Government bonds are of many types but before knowing about the types we should know that there are two categories of bonds first one is marketable and the second one is non marketable.

First, we are talking about non marketable category. In non marketable category, those bonds come which are non marketable, it means it is not transferrable in the name of other persons. RBI Floating Rate Bonds are the best example.

Now let’s talk about the second category where marketable securities come. Here in marketable securities, there are different types of bonds which are as follows.

Fixed Rate Bonds: These are those bonds where the coupon rate was fixed by the RBI at the time of the issue.

Floating Rate Bonds:-these bonds are also called FRB because here the coupon rate fluctuates as per the yields of TBills available in the market at the time of interest payment or at a predetermined date.

Inflation Indexed Government Bonds:-These bonds provide protection from inflation by providing an additional Coupon rate over the Wholesale Price Index (WPI).

Bonds including “(Conv)” in name:-still this is not defined yet.

Bonds including “(C Align)” in name:-still this is not defined yet.

Sovereign Gold Bonds:-These bonds are denominated in gold rates. the new issue price and the redemption price is dependent on the gold rates as per IBJA Rates. it also provides a periodical interest payment which is calculated on the issue price of Gold Bonds.

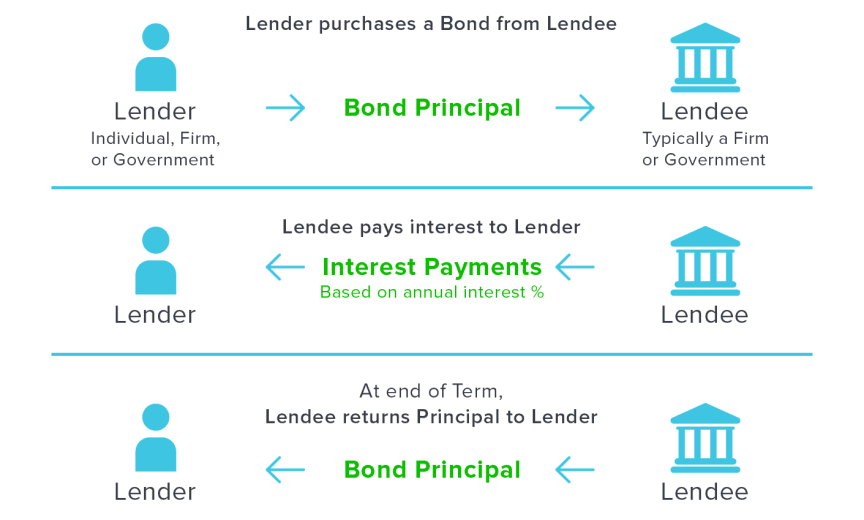

How Government Bonds pays interest?

Government bonds provide interest semi-annually (two times in a year) on predefined dates which depend on the maturity date. Let's understand this with an example suppose a government bond is issued 12-Oct-2015 and the redemption date is 19-Dec-2034 then here the interest will be paid by RBI on 19 December and on 19 June every year till 19 December 2034.

How to Invest in Government Bonds?

Now you can invest in Government Bonds easily without any mutual fund route. In earlier days you have to choose mutual funds routes to invest in government bonds but today we can invest in government bonds through various routes such as NSE Gobid, BSE Direct, Secondary Market (Stock Exchanges) or through Other Intermediaries such as IDBI Samriddhi or any Bank which provides CSGL facility to individuals.

Should you invest in government bonds?

If you are searching for investment assets that can provide you with the highest safety with periodical interest payment then government bonds are the best investment asset class because here each rupee of your investment is guaranteed by the government of India which is the highest security. Before investment, it is highly recommended to you that you should decide the investment horizon and the expected earnings before any investment because here the government bonds are marketable security and the prices of marketable security changes as per market condition so if you think to exit at any point and on that point of time where the other investment asset classes such as interest providing asset(FD) is providing higher yield than your holding's selling price can diminish in the market and vice versa in case of lower yields from other investment asset classes.

Darshan Kolvekar March 14, 2021, 12:24 a.m.

Well explained.