What is a dividend?

The dividend is the appropriation of corporate profits. In simple terms, Appropriation means sharing the profits of the company with the company’s shareholders. It is generally calculated on the face value amount of the shares. Here the face value is the initial capital for any company.

What is Dividend Yield?

Dividend Yield is the formula to calculate the cash inflow within a year. It is calculated by taking the total dividend paid in by the company in a year divided by the price of the share. By calculating this we can know what amount we are getting in the ratio of the price we have paid to invest.

Things to consider before investing in dividend stocks.

Before investing in any dividend stocks you should know that a dividend rate or dividend amount is not fixed every year. Dividend amount changes according to the board of director’s decision. Generally, those stocks which provide high dividend yield are assumed as low growth stocks because in these companies it is expected that it’s better to allocate the profit to shareholders instead of using the profit in business. It is done due to low growth in business or industry. Some of the examples of low growth businesses are coal industry and oil industry etc. dividend stocks provide the best return when it is bought at a good price just like other stocks and also these stocks price perform less if compared with growth stocks.

Now let’s talk about what happens when we invest in a low dividend-paying stock but with high growths.

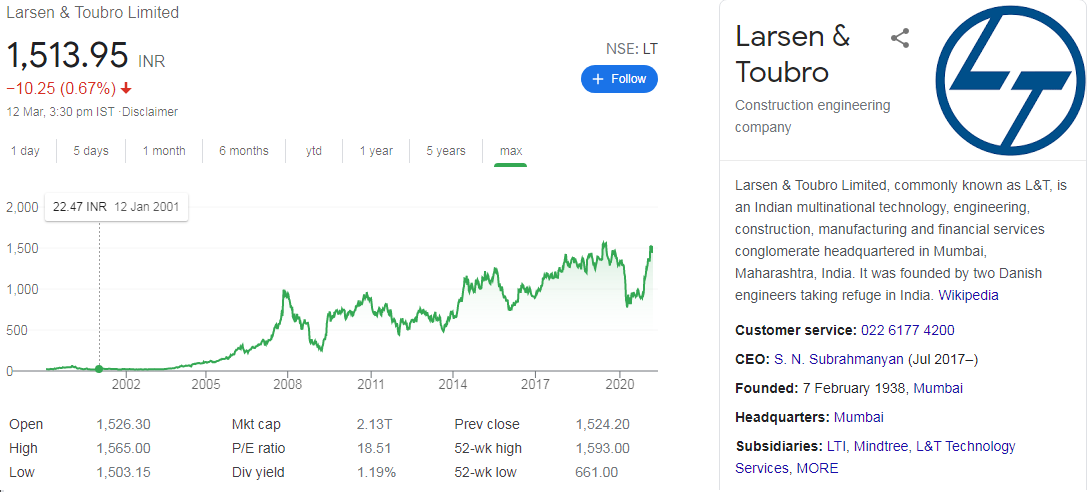

In this case, the dividend is lower in the starting period of investment but later it increases exponentially because of the growth factor within the industry from which the stock belongs or due to the growth in the company’s results year by year. If we understand this with an example then take the example of L&T which was trading at 22.47 on 12th January 2001 and now trading at Rs. 1513.95 with a dividend yield of 1.19%. When we calculate the dividend yield then it will come at Rs. 28.76 which is greater than the investment amount which was invested initially in the year 2001. Generally, these types of stocks are called a growth stock which provides higher dividend yield in later years with good price moverments.

Now let’s talk about top Dividend Paying stocks in India in 2021.

In current time these 7 shares are providing high dividend yields with stable business income with less risk.

Company Name | Ownership | Price on 14th March 2021 | Dividend Yield |

PFC | Government Owned | 138.45 | 6.86% |

ITC | Privately Owned | 205.20 | 4.91% |

Coal India | Government Owned | 150.85 | 10.28% |

Power Grid | Government Owned | 220.00 | 5.01% |

NHPC | Government Owned | 24.60 | 5.73% |

REC | Government Owned | 151.20 | 3.97% |

PTC India | Partly Government Partly Private | 80.65 | 5.89% |

Disclaimer-before investing in any stock you should do your own due diligence because we are not a SEBI Registered entity.