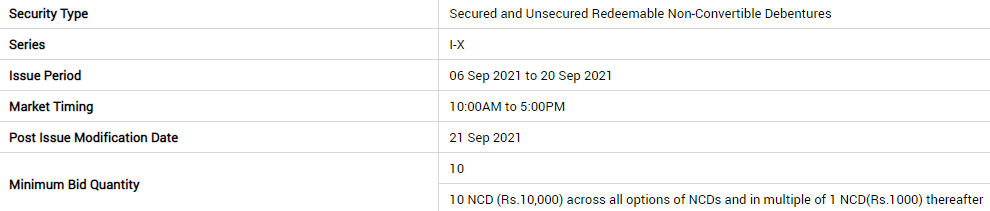

Indiabulls Housing Finance Limited through its board has announced to launch public issue of secured and unsecured non-convertible debentures (NCDs), which will offer coupon rates ranging from 8.42% to 9.75% per annum(For Category III & IV). The issue has a base issue size of ₹200 crore with oversubcription capacity of up to ₹800 crore, aggregating up to ₹1,000 crore. The issue, which will be open for subscription during 6-20 September, has been rated CRISIL AA/Stable by CRISIL Ratings Limited and BWR AA+ /Negative by Brickwork Ratings India Private Limited. Minimum application is to be made for 10 NCDs (i.e. Rs. 10000) and in multiples of 1 NCD (i.e. Rs. 1000) thereon, thereafter. Post allotment, NCDs will be listed on BSE and NSE.

History of Indiabulls Housing Finance

The Company was incorporated as Indiabulls Housing Finance Limited, under the Companies Act, 1956 pursuant to a certificate of incorporation dated May 10, 2005 issued by the Registrar of Companies, National Capital Territory of Delhi and Haryana (“RoC”) and commenced its business on January 10, 2006 pursuant to a certificate of commencement of business issued by RoC. The Company was registered as a non-deposit taking housing finance company registered with the NHB pursuant to a certificate of registration dated December 28, 2005 having registration number 02.0063.05. Further, by notification on September 19, 2007, the Company for the purposes of the SARFAESI ACT, 2005, was specified as a ‘financial institution’ the Central Government At the time of incorporation it was a wholly owned subsidiary of Indiabulls Financial Services Limited ("IBFSL"). Pursuant to the IBFSL-IHFL Scheme involving the reverse merger of IBFSL with the Company in terms of the provisions of Sections 391 to 394 of the Companies Act, 1956, as approved by the Hon’ble High Court of Delhi, vide its Order dated December 12, 2012, IBFSL merged with the Company. It operate under the "Indiabulls" brand name, which is a reference to the Indiabulls group of companies, a diversified set of businesses in the financial services, real estate and securities sectors.

Business of Indiabulls Housing Finance

IBHFL is one of the largest housing finance companies (“HFCs”) in India in terms of AUM. IBHFL is a non-deposit taking HFC registered with the NHB. IBHFL is also a notified financial institution under the SARFAESI Act. It focus primarily on long-term secured mortgage-backed loans and as of the date of this Shelf Prospectus, majority of the loan book comprises of secured loans. IBHFL primarily offer housing loans and loans against property to target client base of salaried and self-employed individuals and micro, small and medium-sized enterprises (“MSMEs”). IBHFL also offer mortgage loans to real estate developers in India in the form of lease rental discounting for commercial premises and construction finance for the construction of residential premises. A majority of the assets under management (“AUM”) comprise housing loans, including in the affordable housing segment, as defined by the RBI. As of March 31, 2021, housing loans and non-housing loans constituted 65% and 35%, respectively of consolidated AUM.

Further IBHFL has a Pan-India presence with 135 offices in 92 cities. In terms of employee strength, IBHFL has a direct sales team of over 1,363 employees. IBHFL also relies on direct sales agents and an online platform for home loans called e-home loans for customer acquisition.

Financials of the Company

For Q1 ended June 30, 2021, and the Fiscal Years 2021, 2020 and 2019, IBHFL's consolidated total revenue from operations was Rs. 2,320.69 crores, Rs. 9,927.42 crores, Rs. 13,216.44 crores and Rs. 17,019.62 crores, respectively. For the Q1 period ended June 30, 2021, its consolidated profit for the period was Rs. 281.69 crores and for the Fiscal Years 2021, 2020 and 2019, consolidated net profit for the period attributable to shareholders of the Company was, Rs. 1,201.59 crores, Rs. 2,199.80 crores and Rs. 4,090.53 crores, respectively.

As of June 30, 2021, and March 31, 2021, 2020 and 2019, its consolidated gross NPAs as a percentage of consolidated AUM were 2.86%, 2.66%, 1.84% and 0.88%, respectively, and r consolidated net NPAs (which reflect its gross NPAs less provisions for ECL on NPAs (Stage 3) for the three months ended June 30, 2021, and the years ended March 31, 2021, 2020 and 2019, as a percentage of consolidated AUM, were 1.55%, 1.59%, 1.24% and 0.69%, respectively. IBHFL's current debt-equity ratio of 4.20 will rise to 4.26 post this debt offering. As of June 30, 2021, its paid-up equity capital of Rs. 89.09 cr. is supported by free reserves of Rs. 15545+ cr. However, the company has reduced dividend pay-outs for the last three fiscal's year over year. It was Rs. 2057.11 cr. (FY19), Rs. 1592.67 cr. (FY20) and Rs. 416.62 cr. (FY21).

Objects of the Issue

The Company proposes to utilize the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

1. IBHFL will utilize 75% of net proceeds for the purpose of onward lending and for repayment of interest and principal of existing debts of the Company; and

2. Rest of 25% of net proceeds will be utitlized for general corporate purposes;

Issue Size

Here the company is issuing Secured, Redeemable, Non-Convertible Debentures of face value of Rs.1,000 each and/ or unsecured, subordinated, redeemable, non-convertible debentures of face value of Rs.1,000 each (“NCDs”), for an amount of Rs.200 Crores (“Base Issue Size”) with an option to retain oversubscription up to Rs.800 Crores aggregating up to Rs.1000 crores (“Tranche I Issue Limit”) (“Tranche I Issue”) which is within the Shelf Limit of Rs.1000 crores (“Shelf Limit”)

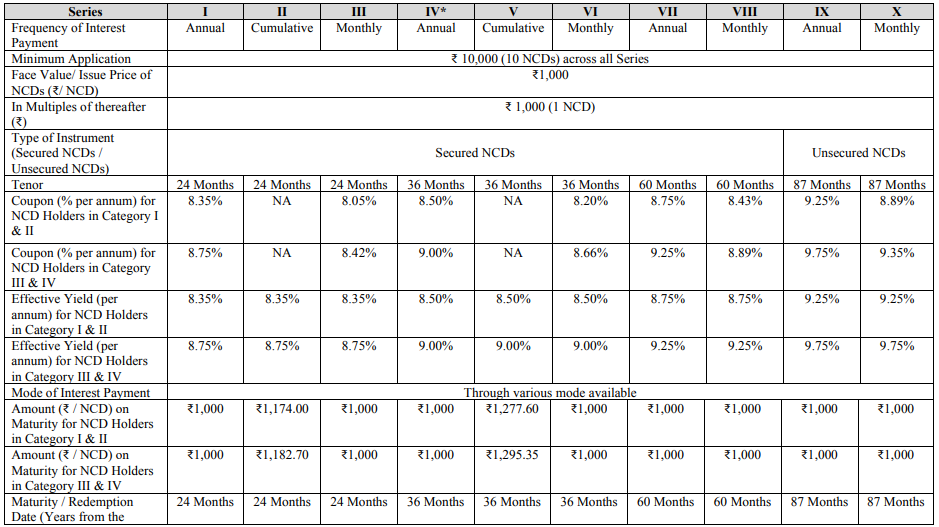

Issue Structure:

Nature of Issue: From Series I to VIII is secured in nature, Series IX and X is unsecured in nature. FurtherThe Unsecured NCDs will be in the nature of Subordinated Debt and will be eligible for Tier II capital and accordingly will be utilised in accordance with statutory and regulatory requirements including requirements of RBI.

Other Issue Details:

How to apply for Indiabulls Housing Finance NCD Issue

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. if you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs or you can also contact us on this number +917003419137 for online application. Now if you are planning to apply here through offline mode then you have to fill the physical application form and have to submit it to your broker.