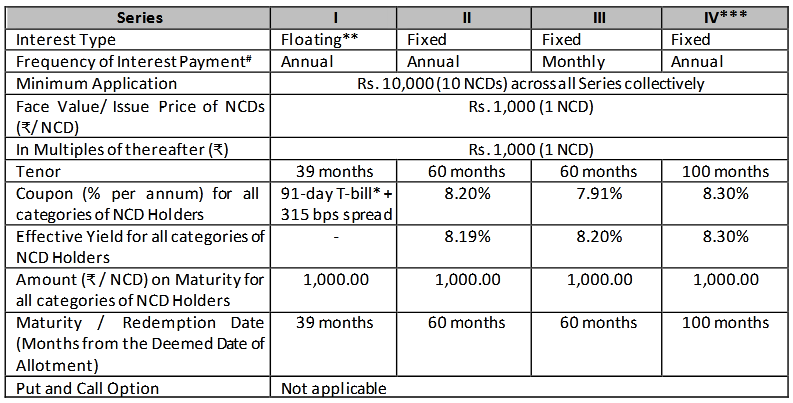

JM Financial Products Limited through its board has announced to launch public issue of secured non-convertible debentures (NCDs), which will offer coupon rates ranging from 7.91% to 8.30% per annum(For all Category of investors) and a Floating Rate NCD which will offer 3.15% or 315 bps spread above 91Days tbill. The issue has a base issue size of ₹100 crore with oversubscription capacity of up to ₹400 crore, aggregating up to ₹500 crore. The issue, which will be open for subscription during 23rd September to 14th October,

JM Financial Products Credit Rating

It has been rated “[ICRA]AA /(Stable)” by ICRA Limited and CRISIL AA/ Stable by CRISIL Ratings Limited. Minimum application is to be made for 10 NCDs (i.e. Rs. 10000) and in multiples of 1 NCD (i.e. Rs. 1000) thereon, thereafter. Post allotment, NCDs will be listed on BSE.

History of JM Financial Products

Company was originally incorporated in Mumbai, Maharashtra as a private limited company on July 10, 1984 under the provisions of the Companies Act, 1956, with registration number 33397 of 1984 and with the name "J.M. Lease Consultants Private Limited". By virtue of section 43A of the Companies Act, 1956, The Company became a deemed public company with the name "J.M Lease Consultants Limited" and received a certificate of incorporation dated July 15, 1992 from the Registrar of Companies, Mumbai, Maharashtra. The Company further became a private limited company with effect from August 17, 2001. Subsequently, by way of a fresh certificate of incorporation dated June 10, 2005 issued by the Registrar of Companies, Mumbai, Maharashtra, Company's name was changed to "JM Financial Products Private Limited". The Company was converted into a public limited company with the name "JM Financial Products Limited" and received a fresh certificate of incorporation consequent to change in status on June 28, 2010 from the Registrar of Companies, Mumbai, Maharashtra. It is a Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND-SI), registered with the Reserve Bank of India under Section 45 IA of the RBI Act, 1934, bearing registration no. B -13.00178 dated March 2, 1998.

Business of JM Financial Products Limited

JMFPL is focused on offering a broad suite of loan products which are customized to suit the needs of the corporates, institutions, SMEs and individuals. JMFPL broadly operates under the following verticals viz. (i) Bespoke financing; (ii) Real estate financing; (iii) Capital market financing; (iv) Retail mortgage financing; and (v) Financial institution financing.

i) Bespoke financing - This vertical caters to corporates and includes all types of bespoke lending to companies across various sectors, promoter financing against listed / unlisted securities and property collateral, acquisition financing, subordinated or mezzanine financing, other secured lending and syndication.

ii) Real estate financing - Real estate financing segment includes loan against land, loan against project at early stage, project funding, loan against ready residential / commercial property and loan against shares.

iii) Capital market financing - Capital market financing segment includes loans against securities, margin trade financing, arbitrage, buy now sell later, ESOP financing, broker financing, public offer financing and personal loans.

iv) Retail mortgage financing - Under this segment, Company offers home loans, education institutions loans and loan against property. Loans under this segment are primarily provided against collateral of property and receivables.

v) Financial institution financing - Under this segment, Company offers loans to RBI registered financial institutions (NBFCs, MFIs, etc) against the receivables in their loan book. The funds shall be used for onward lending to their customers, working capital requirements, refinancing and/or any other purpose as acceptable to the Company.

In addition to the above, JMFPL have ventured into digital led real estate broking/consulting business under the brand name Dwello. The Company, through Dwello, operates primarily in the residential real estate segment and assists buyers during all the stages of their real estate buying cycle. Further, They have entered in the housing finance business through thier Subsidiary, JMFHL. JMFHL has been granted a license to operate as a housing finance company by the National Housing Bank of India in Fiscal 2018. The focus of housing finance business would be to provide home loans to retail customers with a focus on affordable housing segment. JMFPL have also entered into the institutional fixed income business. The focus of the business is on mobilizing debt capital for corporates by way of distribution to various investor segments, sales and distribution in secondary bond markets and credit research.

Financials of the JM Financial Products Limited

JMFPL recorded total revenue / income of Rs. 933.55 CRORE, Rs. 840.71 crore, Rs. 660.65 crore and Rs. 139.48 crore in Fiscal 2019, Fiscal 2020, Fiscal 2021 and for the three month period ended June 30, 2021, respectively. JMFPL recorded pre-provision (impairment on financial instrument) operating profit of Rs. 308.94 crore, Rs. 291.60 crore, Rs. 237.16 crore and Rs. 45.68 crore, in Fiscal 2019, Fiscal 2020, Fiscal 2021 and for the three month period ended June 30, 2021 respectively.

JMFPL recorded profit before tax of Rs. 315.76 crore, Rs. 230.68 crore, Rs. 181.70 crore and Rs. 25.68 crore, in Fiscal 2019, Fiscal 2020, Fiscal 2021 and for the three month period ended June 30, 2021 respectively. JMFPL recorded profit after tax of Rs. 204.30 crore, Rs. 160.13 crore, Rs. 137.63 crore and Rs. 23.86 crore, in Fiscal 2019, Fiscal 2020, Fiscal 2021 and for three month period ended June 30, 2021 respectively.

JMFPL's ROA was 3.07%, 2.78% (adjusted for Covid 19 related provisions 2.99%), 2.54% (adjusted for Covid 19 related provisions 3.41%) and 1.75% (adjusted for Covid 19 related provisions 1.93%) in Fiscal 2019, Fiscal 2020, Fiscal 2021 and the three months period ended June 30, 2021 (on an annualized basis), respectively.

JMFPL's ROE was 13.50%, 9.80% (adjusted for COVID-19 related provisions 10.51%), 7.78% (adjusted for Covid 19 related provisions 10.44%) and 5.20% (adjusted for COVID 19 related provisions 5.73%) in Fiscal 2019, Fiscal 2020, Fiscal 2021 and the three months period ended June 30, 2021 (on an annualized basis), respectively.

Objects of the Issue

The Company proposes to utilize the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

1. JMFPL will utilize 75% of net proceeds for the purpose of onward lending and for repayment of interest and principal of existing debts of the Company; and

2. Rest of 25% of net proceeds will be utilized for general corporate purposes;

Issue Size

Here the company is issuing Secured, Redeemable, Non-Convertible Debentures of face value of Rs.1,000 each, for an amount of Rs.100 Crores (“Base Issue Size”) with an option to retain oversubscription up to Rs.400 Crores aggregating up to Rs.500 crores (“Tranche I Issue Limit”) (“Tranche I Issue”) which is within the Shelf Limit of Rs.1500 crores (“Shelf Limit”)

Issue Structure:

Nature of Security provided for JM Financial Secured NCDs

From Series I to IV is secured in nature. Further The Secured NCDs shall be secured by way of first ranking pari passu charge on the Company’s present and future receivables, excluding such portion of the receivables offered or to be offered to the banks against the credit facilities availed or to be availed by the Company whether by way of loan or debentures or otherwise, and for the purposes of maintaining ‘security cover’ (by whatever name called) under the terms of such credit facilities. Security for the purpose of this Issue will be created in accordance with the terms of the Debenture Trust Deed to ensure at least 100% security cover of the amount outstanding in respect of Secured NCDs, including interest thereon, at any time.

How to apply for JM Financial Products NCD Issue

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. If you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs or you can also contact us on this number +917003419137 for online application. Now if you are planning to apply here through offline mode then you have to fill the physical application form and have to submit it to your broker.