Kosamattam NCD August 2021: KOSAMATTAM FINANCE LIMITED was incorporated on March 25, 1987, as ‘Standard Shares and Loans Private Limited’, a private limited company under the Companies Act, 1956 with a certificate of Incorporation issued by Registrar of Companies, Kerala and Lakshadweep, at Kochi, (“RoC”). The name of the Company was changed to ‘Kosamattam Finance Private Limited’ pursuant to a resolution passed by the shareholders of the Company at the EGM held on June 2, 2004, and a fresh certificate of incorporation dated June 8, 2004, issued by the RoC. Subsequently, upon conversion to a public limited company pursuant to a special resolution of the shareholders of the Company dated November 11, 2013, the name of the Company was changed to ‘Kosamattam Finance Limited’ and a fresh certificate of incorporation was issued by the RoC on November 22, 2013. The Company has obtained a certificate of registration dated December 19, 2013, bearing registration no. B-16.00117 issued by the Reserve Bank of India (“RBI”) to carry on the activities of a non-banking financial company without accepting public deposits under Section 45 IA of the RBI Act, 1934. The NCDs have been rated ‘BWR BBB+’Outlook Stable, by Brickwork Ratings India Private Limited.

Business of Kosamattam Finance

Gold Loan is the most significant product in the product portfolio of the Company. Gold Loan customers are typically businessmen, vendors, traders, farmers, salaried individuals and families, who for reasons of convenience, accessibility or necessity, avail the credit facilities by pledging their gold jewellery with the company under various gold loan schemes. These Gold Loan schemes are designed such that higher per gram rates are offered at higher interests and vice versa, subject to applicable laws. This enables the customers to choose the Gold Loan scheme best suited to their requirements. These Gold Loan schemes are revised by the company, from time to time based on the rates of gold, the market conditions and regulatory requirements. Gold Loans are sanctioned for a tenure of upto 12 months, with an option to foreclose the Gold Loan. In addition to the core business of Gold Loan, they also offer fee based ancillary services which includes microfinance, money transfer services, foreign currency exchange, power generation, agriculture and air ticketing services.

Financials of the Company

The average Gold Loan amount outstanding was ₹43,864, ₹37,366 and ₹33,725 per loan account, for the financial years ended on March 31, 2021, March 31, 2020 and March 31, 2019, respectively. For the financial years ended March 31, 2021, March 31, 2020 and March 31, 2019 , the yield on Gold Loan assets were 17.77%, 19.43%, and 20.56%, respectively.

For the financial years ended March 31, 2021, March 31, 2020, March 31, 2019, March 31, 2018 and March 31, 2017 total income was ₹54,225.97 lakhs, ₹49,933.42 lakhs, ₹47,554.47 lakhs, ₹43,422.65 lakhs and ₹36,031.13 lakhs lakhs, respectively. profit after tax for the financial years ended March 31, 2021, March 31, 2020, March 31, 2019, March 31, 2018 and March 31, 2017 was ₹6,524.61 lakhs, ₹4,766.38 lakhs, ₹4,336.07 lakhs, ₹2,670.75 lakhs and ₹1,573.90 lakhs, respectively. For the financial years ended March 31, 2021, March 31, 2020, March 31, 2019, March 31, 2018 and March 31, 2017,revenues from Gold Loan business constituted 94.89%, 93.73%, 91.44%, 92.07%, and 91.25% of the total income for the respective year.

Objects of the Issue

The Company is in the business of gold loan financing, and as part of business operations, the company raise/avail funds for onward lending and for repayment of interest and principal of existing debts.

The Company proposes to utilize the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

1. For the purpose of onward lending;

2. For repayment of interest and principal of existing debts of the Company; and

3. For general corporate purposes;

The main objects clause of the Memorandum of Association of the Company permits the Company to undertake the activities for which the funds are being raised through the present Issue and also the activities which Company has been carrying on till date.

Issue Size

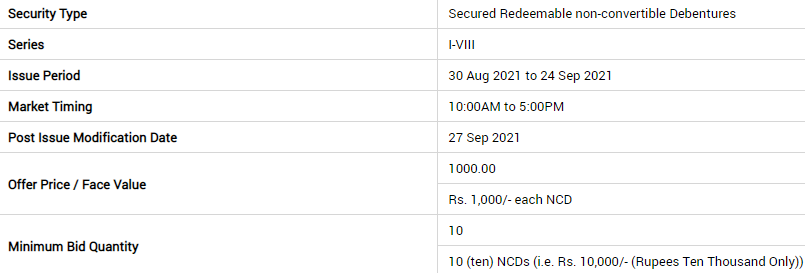

The Company has filed this Prospectus for public issue of secured redeemable non-convertible debentures of face value of ₹1,000 each (“NCDs”) aggregating upto ₹ 15,000 lakhs with an option to retain oversubscription upto ₹ 15,000 lakhs, aggregating upto ₹ 30,000 lakhs (“Issue”).

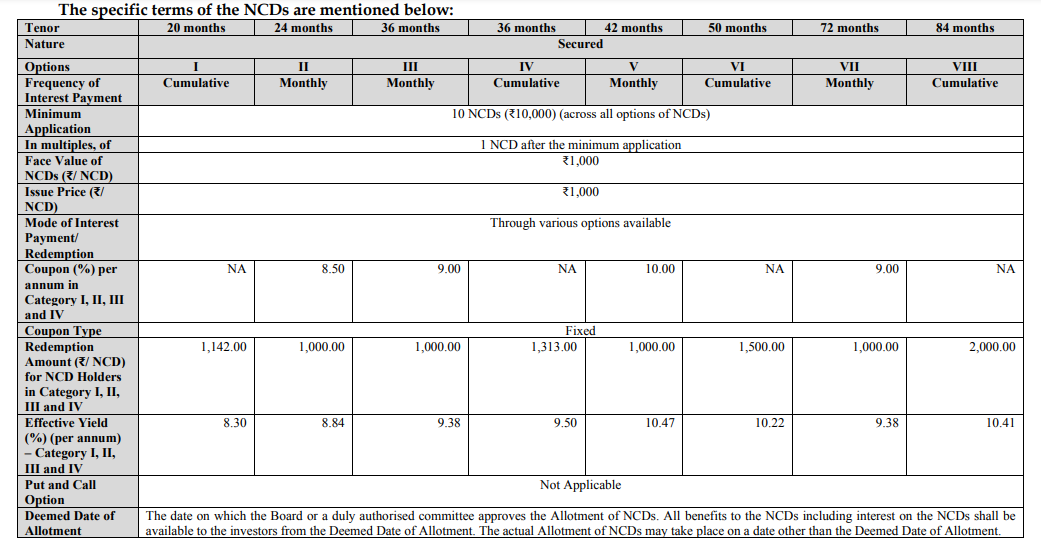

Issue Structure:

Other Issue Details:

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. if you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs. Now if you are planning to apply through offline mode then you have to fill the physical application form and have to submit it to your broker.