Muthoot Fincorp is, a non-deposit taking, systemically important NBFC registered with the RBI bearing registration no.16.00170 dated July 23, 2002, under Section 45 IA of the RBI Act. Muthoot Fincorp has been engaged in the Gold loans business for over a decade and is headquartered in Kerala, India. The Company provides retail loan products, primarily comprising of Gold loans. Gold loan products include Muthoot Blue Guide Gold loan, Muthoot Blue Bright Gold loan, Muthoot Blue Power Gold loan, Muthoot Blue Bigg Gold loan, Muthoot Blue Smart Gold loan and 24x7 Express Gold loan. In addition to the Gold loan business, Muthoot Fincorp provides foreign exchange conversion and money transfer services as sub-agents of various registered money transfer agencies. Muthoot Fincorp is also engaged in the following business:

i. generation and sale of wind energy through its wind farms located in Tamil Nadu; and

ii. real estate business through joint venture developers of the company-owned land parcels;

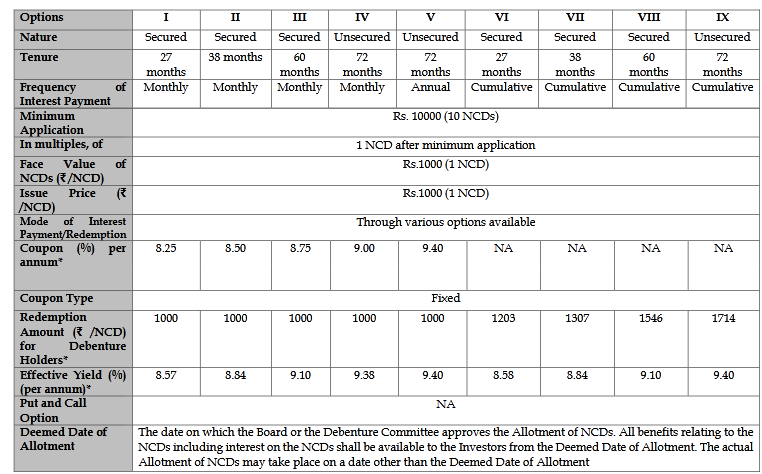

Now let's talk about this issue here in this issue Muthoot Fincorp is issuing a total of 9 series for the public which is as follows

Size of Muthoot Fincorp NCD Feb 2021

Base Issue of Rs. 15,000 Lakhs with an option to retain oversubscription up to Rs. 15,000 Lakhs, aggregating to Rs. 30,000 Lakhs. SEBI circular (SEBI/HO/DDHS/CIR/P/2020/233) dated November 23, 2020, has introduced the UPI Mechanism as an alternate payment mechanism for the Issue, wherein a UPI Investor, may submit the Application Form with a Designated Intermediary or through the app/web-based interface platform of the Stock Exchange and use their bank account linked UPI ID to block of funds if the application value is up to Rs. 2 lakhs.

How to apply for Muthoot Fincorp NCD Feb 2021

If you are planning to invest in this NCD Issue then you need to have a Demat account because without a Demat account you can't apply to this NCD issue(Open your free Upstox account now). if you have a Demat account then you can apply to this NCD issue in three ways.

By applying through Net Banking/UPI ASBA option just like Regular IPOs(Market timing for application 10:00 AM to 5:00 PM)

By applying through Physical form

By using the platform of BSE Direct and NSE Gobid

here Issue Period is 18 Feb 2021 to 09 Mar 2021 you can apply in this NCD issue only between these days

Here you can apply by paying a minimum of Rs. 10,000/-. here each NCD has a face value of Rs. 1,000/- (except series VI to IX) which is going to be redeemed at the face value amount on Maturity Date. for series VI to IX NCDs redemption price are determined as 1,203/-,1,307/-,1,546/- and 1,714/-

Before deciding the investment amount you should know that Corporate Bonds and NCDs have always a default risk, where your funds can get blocked or drawn away for an undefined time if there's any liquidity issue in the company so invest as per your risk-taking capacity and don't forget to diversify your debt portfolio.