Muthoottu Mini Financiers NCD August 2021: Muthoottu Mini Financiers Limited was originally incorporated as ‘Muthoottu Mini Financiers Private Limited’, a private limited company under the provisions of the Companies Act, 1956, pursuant to a certificate of incorporation dated March 18, 1998, issued by Registrar of Companies, Kerala and Lakshadweep (“RoC”). Pursuant to a special resolution passed in the general meeting of the Shareholders held on September 14, 2013, Company was converted into a public limited company and a fresh certificate of incorporation was issued by the RoC on November 27, 2013, and the name was changed to ‘Muthoottu Mini Financiers Limited’. The company holds a certificate of registration dated April 13, 2002, bearing registration number N-16.00175 issued by the Reserve Bank of India (“RBI”) to carry on the activities of a non-banking financial company without accepting public deposits under Section 45 IA of the Reserve Bank of India Act, 1934. Pursuant to the name change of the Company, a fresh certificate of registration dated January 1, 2014, was issued by RBI. The company has a rating of CARE BBB+ Stable (Triple B Plus; Outlook: Stable’) by CARE Ratings Limited.

Business of Muthoottu Mini Financiers: The company has introduced an online gold loan product wherein the customer has to come to the branch only for the initial appraisal and subsequent disbursement is done online based on the customer's request during the maximum period of one year.

The company also offers microfinance loans, unsecured loans to the joint liability group of women customers (minimum of 5 persons) who require funds to carry out their business activities.

In addition to the loan business, the company also offers depository participant services, money transfer services, insurance broking services, PAN card related services, and travel agency services.

Objects of the Issue

The Company proposes to utilise the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), estimated to be approximately ₹25,000 lakhs, towards funding the following objects (collectively, referred to herein as the “Objects”):

1. For the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company; and

2. General corporate purposes.

The main objects clause of the Memorandum of Association of the Company permits the Company to undertake the activities for which the funds are being raised through the present Issue and also the activities which the Company has been carrying on till date.

Issue Size

Public issue of Secured NCDs and Unsecured NCDs by our Company aggregating up to Rs.12,500 lakhs, with an option to retain over-subscription up to Rs.12,500 lakhs, aggregating up to Rs.25,000 lakhs; Base Issue Size being Rs.12,500 lakhs.

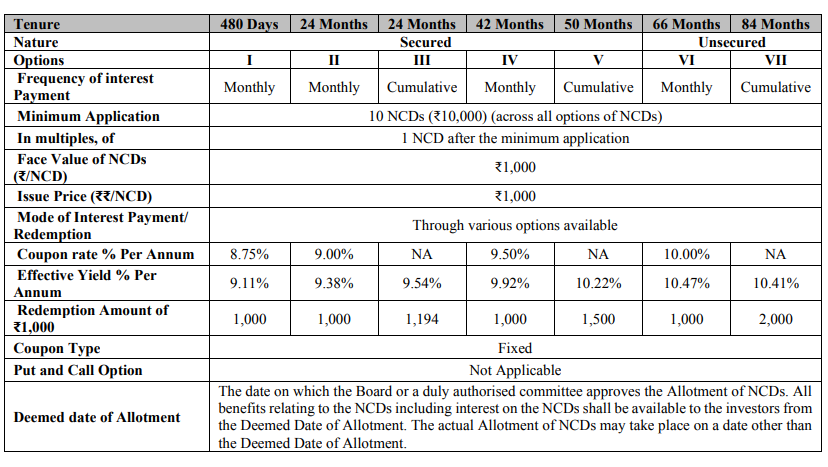

The specific terms of the NCDs are mentioned below:

Nature of Issue: Here series I to V is Secured and series VI & VII is Unsecured.

Nature of Issue: Here series I to V is Secured and series VI & VII is Unsecured.

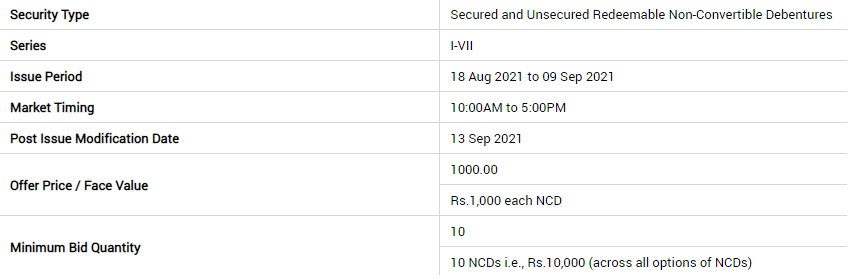

Other Issue Details

How to apply for Muthoottu Mini Financiers NCD

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. if you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs, you can also apply here through using the BSE Direct Platform. Now if you are planning to apply through offline mode then you have to fill the physical application form and have to submit it to your broker.