Piramal Capital and Housing Finance Limited is a wholly owned subsidiary of Piramal Enterprises Limited (“PEL”) which is the flagship company of the Piramal Group. It is registered as a non-deposit taking housing finance company with the National Housing Bank (NHB) and are engaged in various financial services businesses. The Company provides both wholesale funding opportunities to real estate developers, corporates and SMEs across sectors and retail funding opportunities including housing finance to individual customers. In addition to wholesale lending, the business also focuses on retail lending with a differentiated approach towards risk optimised profitability. Under retail lending, the company offer housing finance, LAP, secured business loans, digital purchase finance and digital personal loans. The Company provide financing in the housing industry to existing home owners and new home buyers. They also provide construction finance for residential and commercial projects and financing to large and mid-sized corporate clients. In real estate, the platform provides financing solutions such as structured debt, construction finance and lease rental discounting to developers and housing finance to home buyers. The wholesale business in the non-real estate sector includes separate verticals for the corporate finance group (“CFG”) and emerging corporate lending (“ECL”). CFG provides customized funding solutions to companies across sectors such as infrastructure, renewable energy, industrials, and auto components, while ECL focuses on providing lending services to Small and Medium Enterprises (“SME(s)”). The journey in the financial services started in 2010 with the set up of Piramal Finance Limited (“PFL”), a wholly owned subsidiary of PEL, which was established as an NBFC with focus on real estate funding. Over the years, it built a lending platform to serve the needs of corporates and individuals. Piramal Housing Finance Private Limited (“PHFL”) was incorporated on February 10, 2017, as a fully owned subsidiary of PFL, with a purpose of providing retail mortgage loans to home buyers. On March 31, 2018, The Company was formed by the reverse merger of PHFL with PFL and amalgamation of Piramal Capital Limited (which was a wholly owned subsidiary of PEL). In terms of retail housing finance, They have been offering housing loans to individual retail customers and certain other retail lending products to the customers. Apart from housing loans, under the retail platform, they have also started offering secured business loans and loans against property. In addition, They have been working towards entering into business partnerships with fintechs and other consumer focussed entities of strategic significance to optimise our vision of digital lending. They have pivoted the business strategy from focussing on large ticket affluent home loans to the prime segment of affordable housing loans and mass affluent housing loans. The retail housing portfolio has grown from ₹ 1,32,618 lakh in Fiscal 2018 (constituting 4% of our loan book) to ₹ 5,51,453 lakh as of Fiscal 2020 (constituting 16% of our loan book) in a short span of two years. As of December 31, 2020, they had 19 permanent branches located in various cities across India. The Company have a ‘hub-and-spoke’ model, with physical branches serving as hub locations and technology-led spoke locations. With a lending AUM of ₹ 32,39,400 lakh as of December 31, 2020, the Company has shown consistent growth in asset book and profitability over the years. As of December 31, 2020, the real estate lending, retail lending and CFG contributed 79%, 12% and 7% respectively of the lending book, while the rest of the book included ECL and other financing. The Company had a gross NPA of 2.12% and a net NPA of 1.45% as of March 31, 2020, which is lower than the GNPA range of 2.2-2.4 %in the housing finance sector for FY 2020 (source: CRISIL Report). The company has a CRAR of 34.89% (as per Indian GAAP) as of March 31, 2020, which is higher than the CAR % (Tier I and Tier II) of the leading players in the housing finance sector for FY 2020 (Source: 109 CRISIL Report). The CRAR (as per Indian GAAP) has increased from 29.92% in Fiscal 2019 to 34.89% in Fiscal 2020 and our debt to equity ratio reduced from 1.65 in Fiscal 2019 to 1.44 in Fiscal 2020 indicating a strengthening financial trend in the Company.

Credit Rating of Piramal Capital and Housing Finance

The Company is rated by two rating agencies. CARE Ratings Limited - CARE AA (CWD) (Double A) (Under Credit Watch with Developing Implications) and ICRA Limited - [ICRA] AA with outlook (Negative)

Object of the Issue

at least 75% of the amount proposed to be financed from the Net Proceed will be used for the purpose of onward lending, financing, and for repayment /prepayment of interest and principal of existing borrowings of our Company. Maximum up to 25% will be used for General Corporate Purposes.

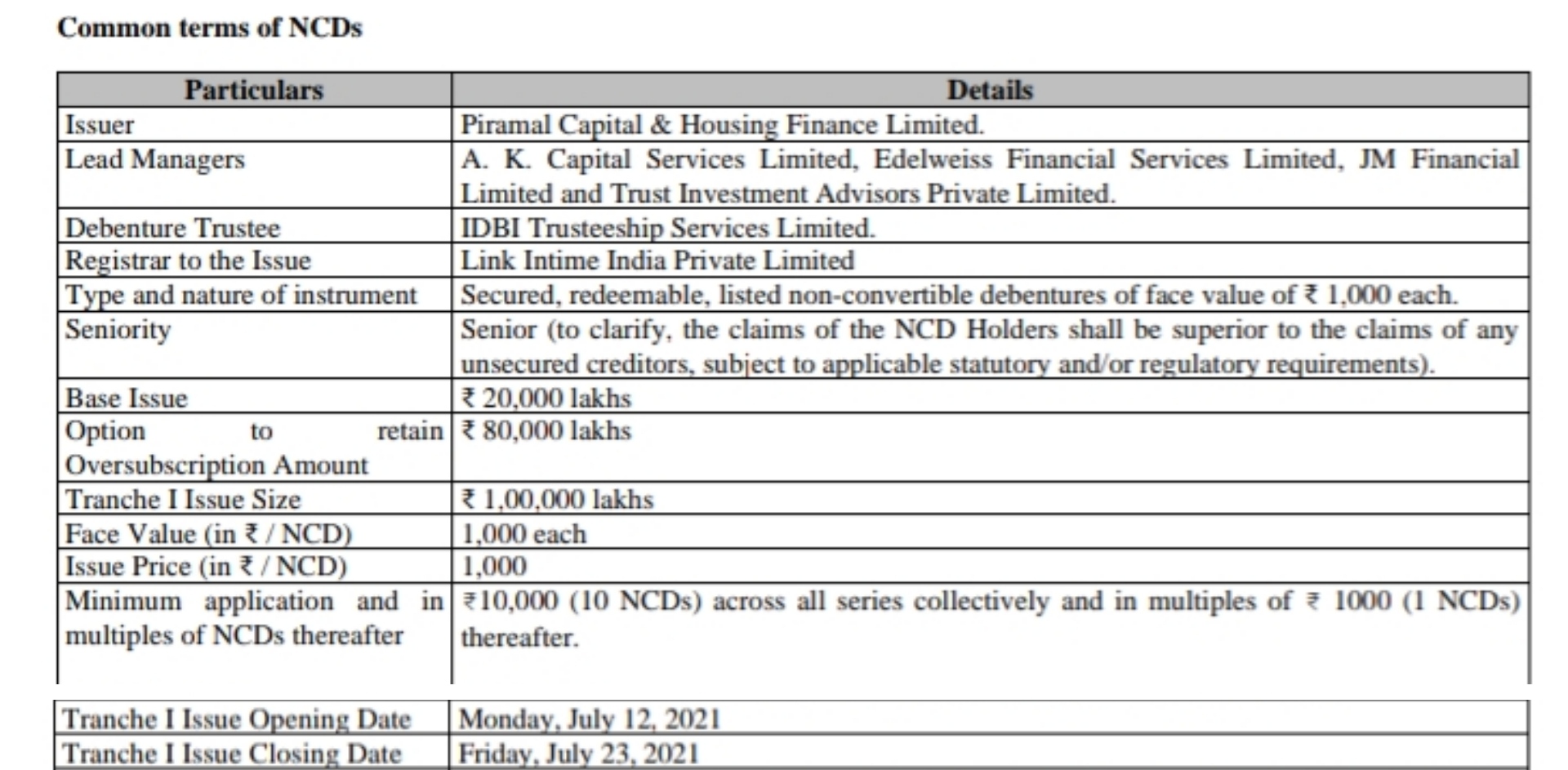

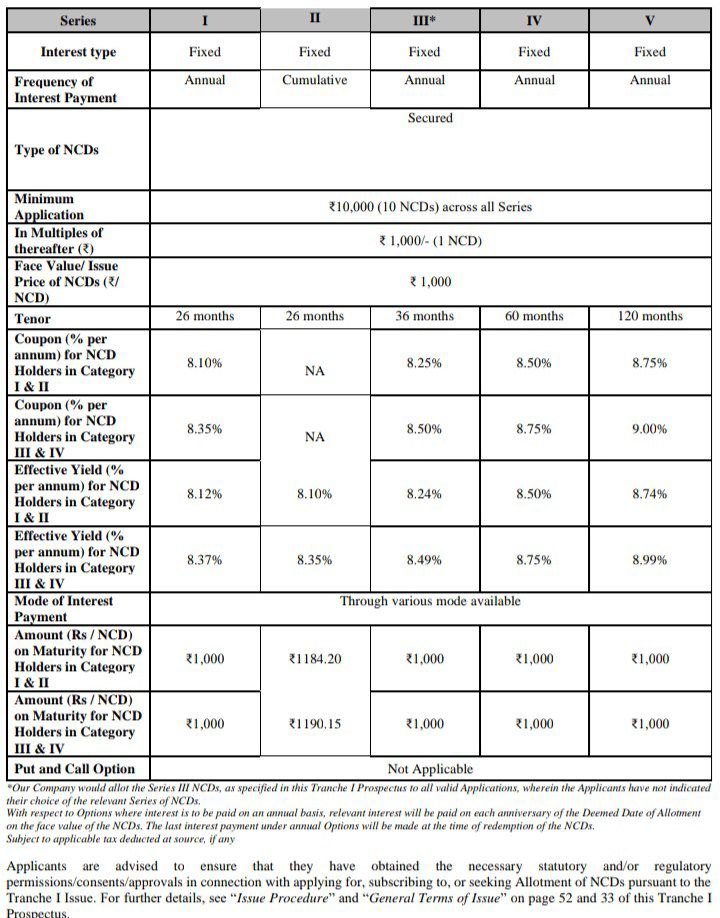

Piramal Capital & Housing NCD Issue Details

NCD Issue Structure

NCD Issue Structure

What NCD Holders are getting in the name of Security

The principal amount of the NCDs to be issued shall be secured by way of a first ranking pari passu charge by way of hypothecation over the standard movable assets of the Company (both present and future), including receivables and book debts arising out of (i) investments (not in the nature of equity investments or convertible instruments); (ii) lending; and (iii) current assets, loans and advances, save and except any receivables arising out of the investments made or loan extended by the Company to its subsidiaries or affiliates, created in favour of the Debenture Trustee, as specifically set out in and fully described in the Debenture Trust Deed, such that a security cover of minimum 100% of the outstanding amounts of the NCDs and interest thereon is maintained at all time until the Maturity Date.

Suggestion:- For complete information do refer to the NCD Prospectus before investing

Sunny Seth - Admin Comment July 4, 2021, 5:32 p.m.

Great Post